Why should you start shopping on credit?

-

Applying for credit is quick and easy.

-

You can shop right away without the hassle of saving up.

-

Everything can be done online from the comfort of your home, and we'll deliver the goods to your door.

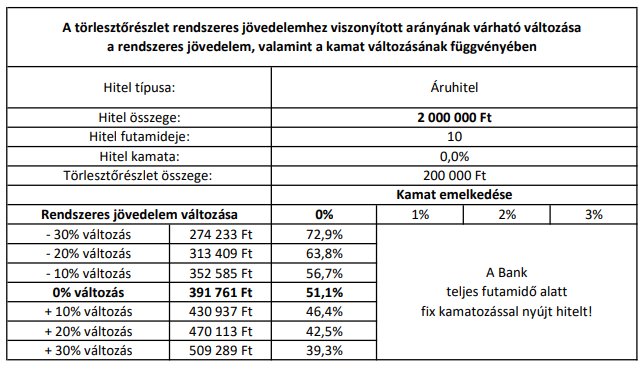

0% interest rate plan example

|

|

|---|

| Price |

| Down payment |

|

|

| Number of monthly installments |

| Monthly installment payment |

| Total amount payable by client |

| Fixed annual interest rate |

| Annual interest rate |

|

|

Consumer loan reference APR 0.0%

For a loan amount of 2,000,000 Ft and a loan term of 10 months.

The reference APR was determined taking into account the specified loan amount and loan term, contrary to the provisions of Section 9 (1) of Government Decree 83/2010 (III.25.) on the determination, calculation, and publication of the total cost of credit for credit agreements, with deviations.

Loan term: 10 months. The loan amount that can be requested ranges from 25,000 Ft to 2,000,000 Ft. Down payment is not mandatory but may vary based on the customer's choice and/or the result of the credit assessment.

Alza.hu Kft. acts as an intermediary for Magyar Cetelem Zrt. (Bank). The Bank reserves the right to determine the necessary documents for credit assessment and to conduct the credit assessment, and excludes any obligation to provide an offer. Further details are available in the Bank's General Business Conditions, General Terms and Conditions, and relevant notices, which can be viewed or downloaded at https://www.cetelem.hu/segedlet/dokumentumok.

Valid from September 19, 2023, to December 31, 2023, for products specified in the online store.

Consumer loan reference APR 0.0%

For a loan amount of 2,000,000 Ft and a loan term of 20 months.

The reference APR was determined taking into account the specified loan amount and loan term, contrary to the provisions of Section 9 (1) of Government Decree 83/2010 (III.25.) on the determination, calculation, and publication of the total cost of credit for credit agreements, with deviations.

Loan term: 20 months. The loan amount that can be requested ranges from 50,000 Ft to 2,000,000 Ft. Down payment is not mandatory but may vary based on the customer's choice and/or the result of the credit assessment.

Alza.hu Kft. acts as an intermediary for Magyar Cetelem Zrt. (Bank). The Bank reserves the right to determine the necessary documents for credit assessment and to conduct the credit assessment, and excludes any obligation to provide an offer. Further details are available in the Bank's General Business Conditions, General Terms and Conditions, and relevant notices, which can be viewed or downloaded at https://www.cetelem.hu/segedlet/dokumentumok.

Valid from September 19, 2023, to December 31, 2023, for products specified in the online store.

Downloadable documents

Links

- Information on the risks of excessive debt: https://www.mnb.hu/letoltes/tulzott-eladosodottsag-tajekoztato-2023-12-22-clean.pdf

- Cetelem documents: https://www.cetelem.hu/segedlet/dokumentumok

How do I shop on installments?

-

On the product page, click on the Buy on Installments button. Choose the number of months for how long you want to pay the loan. Proceed as you would with a regular purchase.

-

Fill in all the necessary information in the application, and Cetelem will evaluate your request.

-

After approval, you will sign the credit agreement online, and we will send you the goods.

-

Collect your purchase and enjoy.

Conditions for submitting a loan application

- Natural person

- Has reached the age of 18

- Permanent address in Hungary

- Verified, regular income

- Direct contact by landline or prepaid mobile phone at the residence

- For employees, direct contact by phone at the workplace or place of work

- Not in probation or notice period in active employment

Required documents

- Valid permanent personal identification card issued by Hungarian authorities, or valid identity card and address card, new type driver's license in card format and address card, or valid passport and address card

- The types of documents that prove income may vary depending on whether the applicant is an employee; an individual entrepreneur or business owner; a primary producer; or a pensioner. More information is available below

- The condition for credit approval is the accurate and complete completion and signing of the forms, and the submission of all documents requested by the Bank is always necessary to conclude the loan agreement.

How can I tell what products are covered by this interest-free 0% APR online installment credit policy?

This icon indicates that the product that can be purchased on the 0% interest rate plan

FAQ

Additional information on terms and documents

Our bank accepts loan applications from individuals who meet the following requirements:

- Natural person.

- Has reached the age of 18.

- Permanent residence in Hungary.

- Documented regular income.

- Direct contact via landline or prepaid mobile phone at the residence address.

- For employees, direct contact via phone at the workplace or work location.

- A person in active employment must not be in probation or notice period.

The following documents are essential for verifying the information required for loan approval:

1. Identification and address documents

- Valid permanent identity card issued by Hungarian authorities, or valid personal identification card and address card, new format driver's license and address card, or

- Valid passport and address card

2. Income documents

- If you are an employee – A statement of employment (on the form provided by Magyar Cetelem Zrt. or other employment certificate containing the data listed on the form provided by Magyar Cetelem Zrt.), not older than 30 days, confirming a permanent employment relationship of at least 3 months with the same employer either indefinite or for the duration of the loan, OR

- The last 3 statements from the bank account that contains the applicant's active income from the same employer for at least 3 months, or their pension, in a way that can be determined in terms of both title and amount. The account statement must also verify the applicant's address, the employer's name must be listed in the income line, and the income must be transferred from the same employer on all three statements.

- If you are self-employed or a business owner – For entrepreneurs (owners of economic entities, sole proprietors, and employees of family businesses), an income certificate from the tax authority.

- If you are a primary producer – An income certificate from the tax authority.

- If you are a pensioner: (1) Your most recent pension slip or a payment account (bank account) statement not older than two months, which contains the retiree's pension in terms of both its legal basis and its amount, and which is in the name of the customer or in the joint name of the customer and their spouse, or the annual summary of the pension amount for the current year. (2) The annual summary of the pension amount for the current year. (3) In the case of disability or rehabilitation benefits, a decision establishing the disability or rehabilitation benefit, which states that the benefit is granted for at least the duration of the loan.

In addition to the documents listed above, the bank may request additional documents. In the case of other income replacement benefits, the bank will decide on creditworthiness on a case-by-case basis. If the employment certificate is not provided, the owner of a business entity, the non-employee manager of a business entity, the self-employed, and the employee of a family business are not entitled to apply for a loan.

Agent information

-

a) Company name: ALZA.HU Kft. Registered office: 1134 Budapest, Róbert Károly körút 54-58. Registration ID (company registration number): 01-09-286873 Postal address:

1134 Budapest, Róbert Károly körút 54-58. Supervisory authority: Hungarian National Bank (central mailing address: 1850 Budapest, central phone number: (36-1) 428-2600, central fax: (36-1) 429-8000, e-mail: [email protected] - b) Our company is listed in the register of intermediaries maintained by the Hungarian National Bank. The register can be checked at the above contact details and through the www.mnb.hu website.

- c) Our company acts as a dependent intermediary on behalf of Magyar Cetelem Zrt and represents the interests of the principal.

- d) Our company receives intermediary compensation for concluding financial service contracts.

- e) Our company does not provide a service of providing personalised recommendations (loan advice), which is separate from the provision of loans and loans, financial leasing, and the provision of financial services.

- f) Magyar Cetelem Zrt. ensures that the customer can communicate a complaint about our company's behavior, activities, or omissions in writing (in person, by phone) or in writing (in person or by other means of delivery, by post, by fax, or by e-mail). Magyar Cetelem Zrt. accepts verbal complaints in the premises open to customers during opening hours, verbal complaints received by phone from 8:30 am to 5 pm on weekdays and one working day a week (Monday) from 8 am to 8 pm, and written complaints electronically at (Magyar Cetelem Zrt). Magyar Cetelem Zrt. examines verbal complaints immediately and, if necessary, remedies them. If the customer disagrees with the handling of the complaint or immediate investigation is not possible, Magyar Cetelem Zrt. records the complaint and its position, and provides a copy of it to the customer in the case of verbal complaints submitted in person or sends it to the customer in the case of verbal complaints submitted by phone. Otherwise, Magyar Cetelem Zrt. responds to written complaints with a reasoned position within the statutory deadline. If a complaint about the services or procedures of Magyar Cetelem Zrt. or our company is rejected, or if the consumer does not agree with the handling of the complaint, the consumer may contact the following bodies:

- a. For the settlement of disputes concerning the conclusion, validity, effects, termination of contracts, and breach of contracts, as well as their legal consequences, the consumer may turn to the court according to the rules of the Hungarian Code of Civil Procedure or initiate proceedings before the Financial Arbitration Board. The Financial Arbitration Board's current contact information: Pénzügyi Békéltető Testület H-1525 Budapest Pf.:172., telefon: +36- 80-203-776, Pénzügyi Békéltető Testület

- b. In case of a violation of consumer protection provisions referred to in the law on the Hungarian National Bank, a consumer protection procedure may be initiated at the Hungarian National Bank. Mailing address: Magyar Nemzeti Bank 1850 Budapest, phone: 06-1-428- 2600, e-mail: [email protected]

- Our company charges a delivery and extended warranty fee for the following other services that do not constitute the provision of financial services.